What is your bank account really paying you? Recent investigations have shown that many consumer banks are paying way below market interest rates to many of their savings accounts, and hoping that their customers don’t notice. That’s money you deserve.

Banks have to tell you the truth about what they’re paying you and charging you – that’s the law!

Thanks to the Truth in Savings Act, a federal law that applies to all banks, banks have to give you an accurate list of all the interest rates and fees that apply to your savings account. That information has to be given to you whenever you open an account and whenever you ask. It applies to any savings, checking, certificate of deposit (CD), or money market account. This lets you shop around for the best deal!

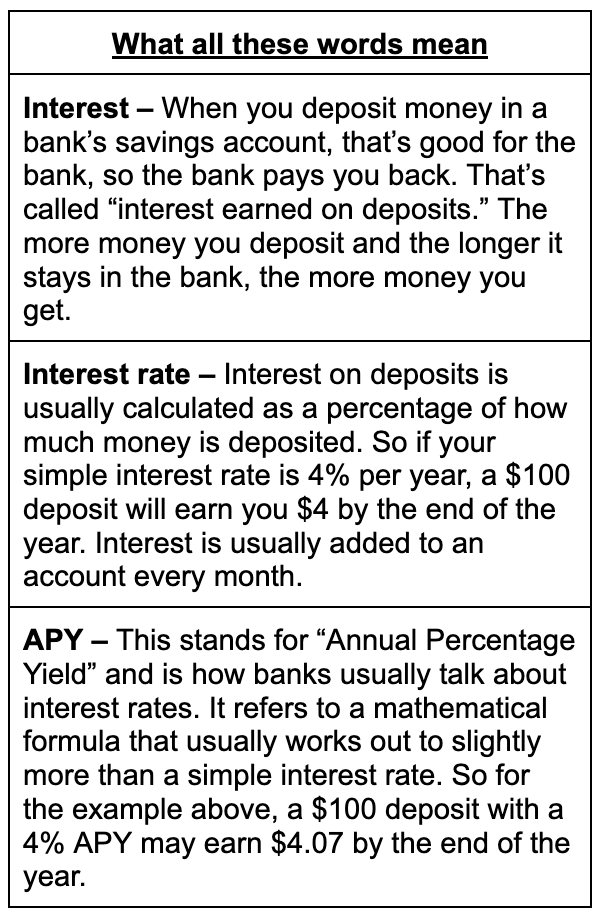

Moving your money to a high-interest savings account can make a big difference. The average single parent has $2,400 in savings. Moving from a low-interest account to a high-interest account could mean almost $100 more cash by the end of the year.

But look out – banks can be tricky. In January 2025, the Biden Administration actually took one bank, Capital One, to court. The Consumer Financial Protection Bureau under Biden said that Capital One managed to take away $2 billion from customers by confusing them about what interest rates the bank was paying.

Here’s how you can find out whether or not you’re getting a good deal on your savings account:

Check Out What Interest Rate You Are Getting

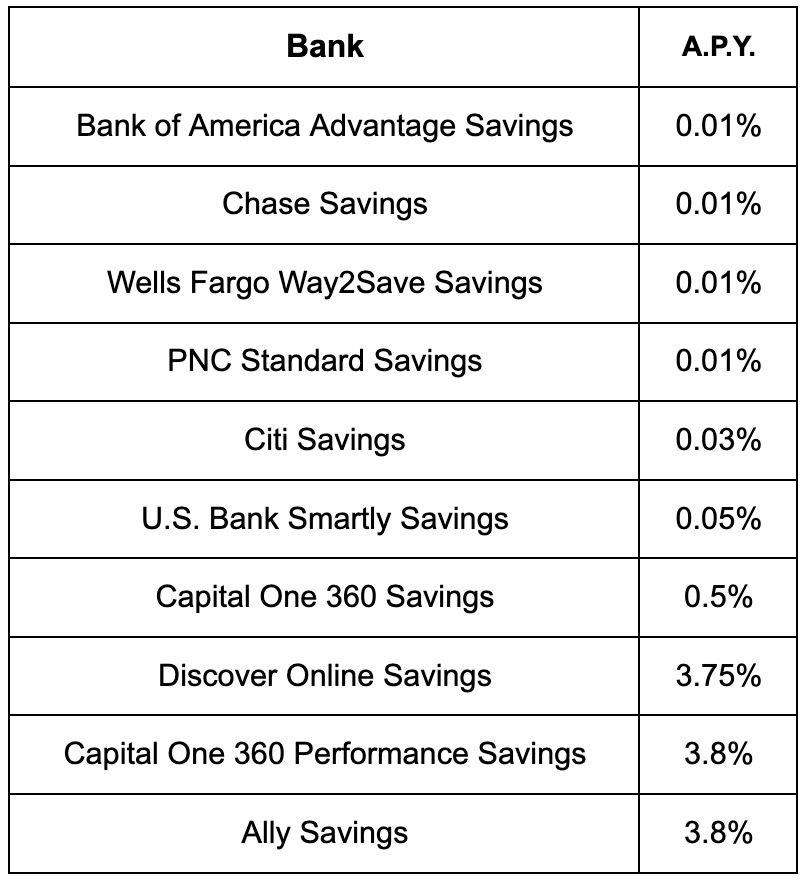

Look on your monthly statement or your bank’s website for the interest rate of your account, often listed as the APY. This should be a percentage number, something between 0.01% and 5%. This is how much money you get back in interest in a year. If you can’t find it, contact your bank.

A higher interest rate on your savings account means more money for you – but make sure you’re getting an account that makes sense for you. Different accounts will have different rules. Often, savings accounts with higher interest rates also require you to keep a minimum balance. Other accounts are called “certificates of deposit” and require you to leave the money in the bank for a period of time and not take it out. Make sure the account has all the features you need.

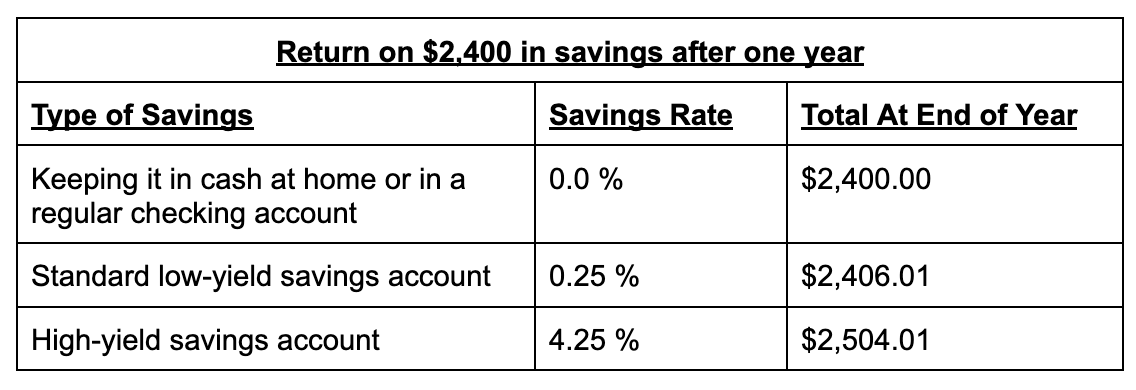

Here are some examples of interest rates offered on standard savings accounts by different banks in January 2025, according to the New York Times:

You can go to consumer websites like Bankrate and Nerdwallet to see a list of what different banks are offering for interest rates on savings. But be sure to read the details carefully – these are for-profit websites who may make money off directing you to certain banks and not others.

Watch Out for “Teaser Rates” and Fees

Lots of banks will try to encourage you to choose their savings account by offering a special higher “teaser” interest rate that only applies for a short time before they switch you to a lower rate. Be sure you learn what the permanent interest rate is.

Also, some savings accounts come with fees that will wipe out any money you make from interest if you drop below a certain balance or take out money too often.

All of these teaser rates, fees, and other costs have to be disclosed to you under the Truth in Savings Act. Contact your bank if you can’t find the information on your statement or their website.

Read More About Your Banking Rights

You can read more about your rights as a bank consumer under the Truth in Savings Act on this Fact Sheet from the Treasury Department.

Other laws passed by Congress give you the right to see your credit report, get timely access to the money you have in the bank, and more. You can read about these rights at the Treasury Department site: BankWise – Your Rights Simplified.

Keep an Eye on the News

That lawsuit against Capital One mentioned above? After the suit was filed, the next Administration dropped the lawsuit when they took over in January of 2025, allowing the bank to walk away without facing any penalties for the alleged fraud. The new administration also shut down much of the Consumer Financial Protection Bureau.

Several of the regulators that keep big banks and other large corporations in check may face changes under the new Administration.

The Fight Ahead

Many of the government and nonprofit programs that help working people could face changes or even total shutdown for next year given the current debate in Washington. Working America will be joining our allies in advocating for a fair economy and a government that gives working families what they deserve. Our strength comes from you – our members. Only by acting together can we fight back against the greedy corporations and their friends.

We’re asking all Working Americans to pledge to stay informed about what policies our leaders are advancing that support a fair economy and protecting consumers. Sign up here if you pledge to be part of that mission and if you want Working America updates and opportunities about a fair economy.

We know that these are uncertain times, and many of us are concerned about the future. Go to workingamerica.org/gethelp for more guides and tips on navigating the economy and preparing for the unknown.